No Credit Check Loans

Online Credits originate from Direct Lenders Only Are you looking for direct lenders to provide no credit checks? Finding the right cash advance online requires some time and effort but with CitrusNorth.com – No Third Party platform you can get the loan you need, however we make it a simple and simple task regardless of …

‘Banned Books’ Exhibit Sparks New Debate at TEAM Meeting

[ad_1] Critics of the recent ‘Banned Books Week’ exhibit at Staples High School – identified only as ‘WPMom3’, left, and ‘Katerina’ – called the sexual content and other information in the books completely inappropriate for students from high school when they spoke at TEAM The Westport Reunion on Thursday. / Screenshots by John Schwing By …

How did Daemon Targaryen die in George RR Martin’s books?

[ad_1] Daemon Targaryen was one of George RR Martin’s favorite characters in Fire & Blood, on which the TV sensation House of the Dragon is based. A few weeks later, it’s clear the show isn’t 100% faithful to the books – but many fans praised Matt Smith for portraying Daemon accurately to Martin’s original writing. …

6 books to add to your summer reading list

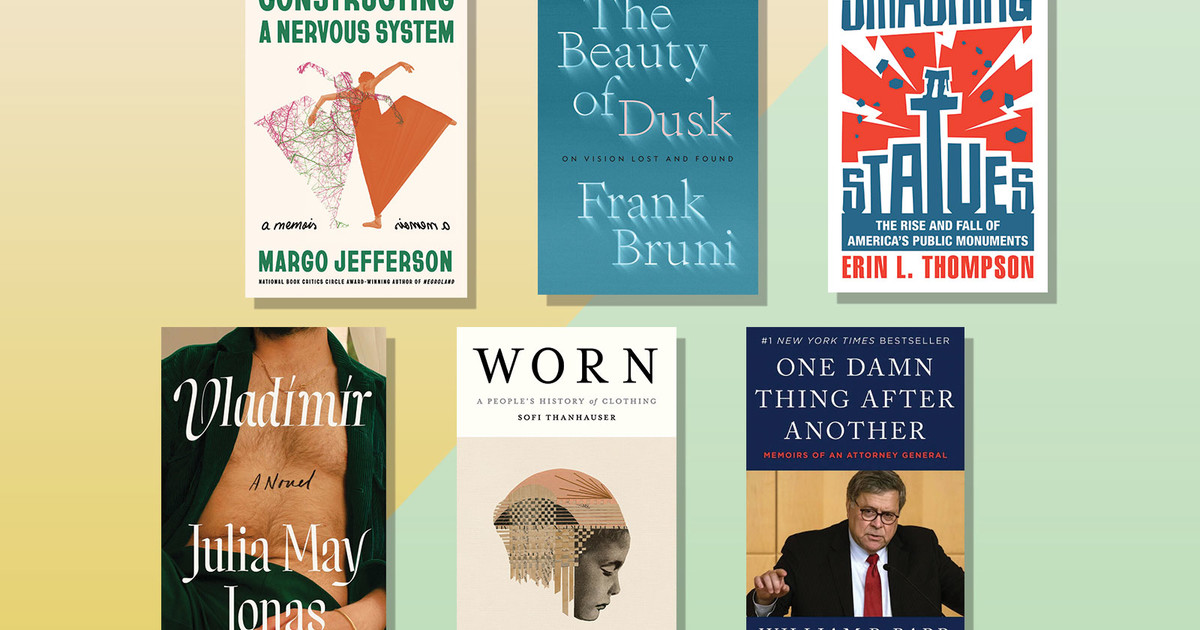

[ad_1] Building a nervous system By Margo Jefferson ’71JRN In this dazzling sequel to his remarkable memoirs Negroland, Pulitzer Prize-winning critic and Columbia writing professor, Margo Jefferson weaves her own memories and “raw intimacies” with stories of black artists who influenced her, including a particularly moving ode to Ella Fitzgerald, whose talent singular has often …

/cloudfront-us-east-1.images.arcpublishing.com/artear/SEC5YJJPMRF6NHZ3BBDWP2G6AQ.jpg)

What to do this weekend in Buenos Aires: activities at the Book Fair and classical music at the Faculty of Law

[ad_1] Book fair 2022: the return of attendance After two years of pandemic, The Book Fair has reopened and its 46th edition will last 19 days. This Saturday will feature exceptional activities. At the Pavillon Rouge, Florencia Bonelli will present “El Spell del Agua” with Mariana Arias, her latest novel, already the number one seller …

The art of resilience: how the museum weathered the crisis | Books

[ad_1] Je Museum: A Brief History of Crisis and Resilience is a book born out of the pandemic. Originally conceived in early 2020 as a snapshot of the current state of museums and their future direction, the project took on new meaning – and a new trajectory – as the coronavirus swept the world. “Like …

DeSantis cancels Disney, math books removed

[ad_1] It’s Earth Day, but in Florida it’s culture war week. The week began with what was supposed to be a special session to simply approve a redistricting map of Congress. By the way, Congressional maps are supposed to be drawn by the Florida Legislature. And they were until Governor Ron DeSantis tossed the lawmakers’ …

6 Student Loan Forgiveness Programs for Pharmacists

Despite the financial and professional rewards, a pharmacy degree can be expensive. If you qualify for student loan forgiveness, however, these costs become much more manageable. Whether you’re a new graduate or someone considering ways to afford pharmacy school, these pharmacist loan waiver programs might be worth pursuing. Can pharmacists get loan forgiveness? There are …

The Albert Harris Center in Pepperell is offering fun new activities this winter – Lowell Sun

[ad_1] PEPPERELL — The Albert Harris Center, formerly known as Pepperell Senior Center, is offering fun new activities this winter, according to an announcement from the Center. The staff, known for their kindness and benevolence, is the reason why the center is called “Your home away from home”. Unfortunately no food will be served in …

Locals and tourists flock to Ghirardelli Square for vacation activities, Dim Sum – CBS San Francisco

[ad_1] Food for Bay Area Families: Evergreen School DistrictKiet Do reports Evergreen School District donated nearly $ 19,000 to Second Harvest of Silicon Valley (12-27-2021) 4 hours ago Icy Storm Conditions Blanket Bay Area Mountain Peaks With SnowDarren Peck reports snowfall over Bay Area peaks on Monday (12-27-2021) 4 hours ago Rising COVID Cases Disrupt …

Father Brian Darcy to sign books in Tipperary today

[ad_1] The well-known clerk will be at Bookworm, Liberty Square, Thurles Father Brian D’Arcy is Ireland’s best-known religious. Over fifty years as a priest, journalist and broadcaster, he has been the most outspoken commentator on topical, religious, social and political issues. And, he signs his new book – It has to be said – at …

The 10 Best Comics From Last Week That Are Growing In Value Include Deadpool, X-Men, Miles Morales And More

[ad_1] Want to know which comics are trending each week and why? COVRPRICE.COM uses live sales analytics to identify and compile the most reliable market price guide, highlighting the trending comics every week. No opinion. Just data. Each week, they present a newly updated list of TOP 10 comics. These trends are due to rumors, …